According to the Congressional Budget Office, inflation is expected to slow over the next two years and approach the Federal Reserve’s target rate of 2%. Meanwhile, mortgage rates are predicted to improve in the near future. For example, the Mortgage Bankers Association predicts that rates for a 30-year fixed-rate mortgage will decrease from 7.4% in 2023 to 5.4% in 2026. Both trends will contribute to an influx of banking customers requiring onboarding and origination services.

Customers seeking new or additional services will choose providers that are easy to work with and make it easiest to access the services they need. Unfortunately, there exists a significant drop-off rate as customers sign up for financial services. Obstacles such as unnecessary queries, slow responses, and unclear experiences lead customers to discontinue their engagement, resulting in lost opportunities for financial institutions.

Streamline account opening flows

An integral part of CX, origination is the start of the customer relationship. A customer-centric origination process contributes to customer satisfaction, trust, and loyalty by emphasizing efficiency, transparency, and personalization. CX plays a crucial role in determining whether customers will continue to engage with a company or not. As competition continues to grow and customers become more digitally savvy, providing seamless origination flows has become increasingly important for businesses to stay competitive.

Increase revenue by prioritizing CX

Improving CX in origination flows can also have a ripple effect on other areas of the business. For example, streamlining and digitizing processes can result in increased efficiency and productivity, freeing up resources that can be reallocated to other revenue-generating and higher-level activities.

Use assessments to overcome online account opening challenges

Both the benefits and challenges of improving origination flows are top of mind for banking executives. A recent SoftServe/American Banker survey shows this, revealing that among the top three benefits bank executives expect technology to deliver to their business are: reduced friction in customer journey (46%); lower operating expenses (43%); and improved customer onboarding (39%).

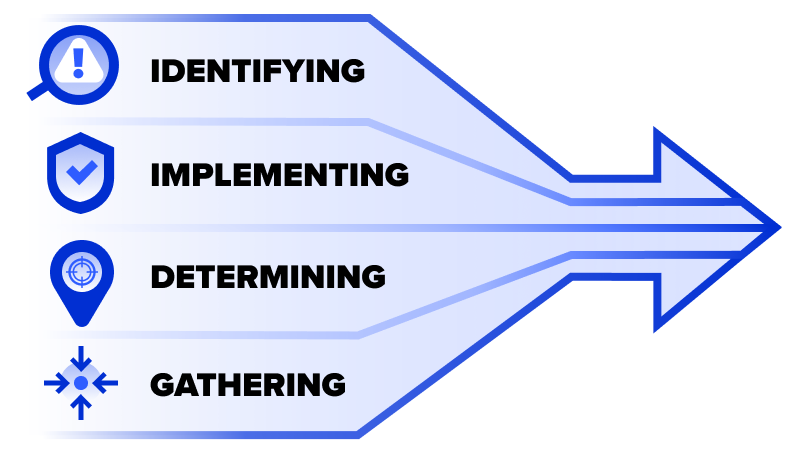

Here is where assessments can make a significant impact. They help banks develop a roadmap for improvement by:

- Identifying areas to improve

- Implementing a user-friendly interface or making current ones more user-friendly

- Determining where and how to utilize technology such as AI and chatbots

- Gathering data and utilizing customer feedback

SoftServe brings experience and expertise in conducting assessments that aid in making better decisions about risk and fraud management, handling thin-file customers, and enhancing the overall origination and onboarding experience.

By accurately identifying performance bottlenecks, customer drop-off points, and high-cost steps, SoftServe can formulate a strategic plan to streamline processes and improve CX — from origination through to ongoing business opportunities.

Let’s talk about how we optimize your CX in origination flows so you’re prepared to meet growing demand as economic trends change and drive an increase in business.