Product Due Diligence: Reducing The Doubt About An Investment Decision

Private equity organizations expose themselves to a risk of poor investment decisions if they skip expert evaluation of an acquisition target’s potential. This is especially true of targets operating as software technology companies. These targets require investigation, as associated risks are too costly to ignore.

- The investment plan does not meet the client’s goals.

- There are misaligned products or companywide critical weaknesses.

- There is a vague understanding of the target’s value proposition.

- There is no vision for future growth potential.

Due diligence is also useful as an enabler for post-acquisition steps such as cloud migration, modernization, and functional capability enhancements. The benefits are worth the investment. Detailed risk management and expectation management can be achieved not by generalizing but by separating analysis into product and technical due diligence assessment. We will go deeper into the product assessment framework and how it helps private equities achieve what they want.

It all starts with data

Identifying the potential risks of an investment in a product company or startup and shaping your post-investment value-driven strategic roadmap are crucial success factors in making a sound decision. However, trials to conduct an accurate evaluation or business analysis on your own can be a daunting task, especially if uncertainties in selecting the best investment target vary.

- What are the scenarios of a company’s revenue and capitalization?

- Does the company’s product sustain domain-specific demands?

- What technical risks can reduce a product’s chances on the market?

- Are the target company’s insights based on reality?

If you are a private equity investor attracted by the promise of high returns, consider that promises without data-driven proof imply higher risks. Due diligence consulting services can help reveal red flags and suggest a strategic post-acquisition roadmap to increase the investment’s success while optimizing internal efforts.

Product due diligence key aspects

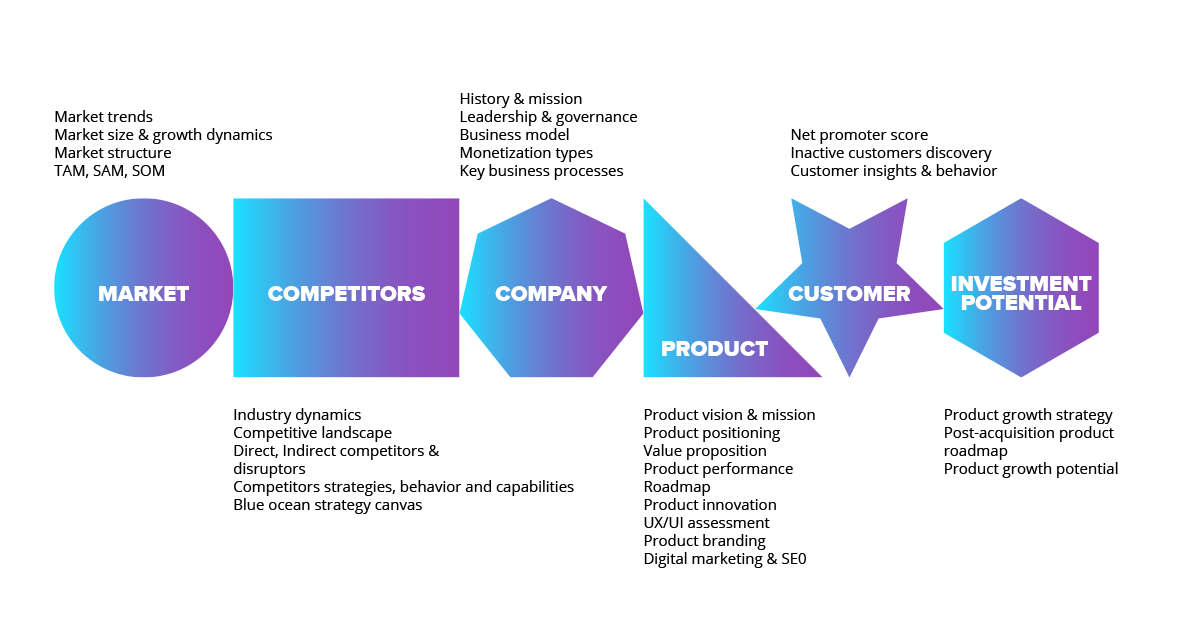

Product due diligence is the process of assessing and analyzing a target product’s potential from these essential perspectives:

- Market analysis and opportunity definition

Attracting and retaining customers depends on the proficient assessment of market trends, market size and position, market growth rate, and market demand. Holistic market analysis plays a decisive role in identifying the scope of a product's strengths and weaknesses. - Owner’s product vision

The analysis includes evaluating the product’s vision and mission from the founder’s perspective. It gives insight into why a software business model was chosen and into the reasoning for revenue stream projection, the target audience, and more. For investment decisions, it can also be beneficial to help understand if the product vision and mission align to address specific problems in the market or promote customer adoption. - The product scope, design; maturity, and management

Is the product ready to be an industry leader? The product assessment looks into product management, operational capabilities, market relevance, value proposition, and product functional and non-functional capabilities. An assessment team analyzes product innovation potential, reviews the product roadmap, and performs UI/UX assessment. At SoftServe, we extricate information about how key management processes are built and analyze them through a product development history prism. - Competitive pressure

The profit potential is compared against the competition. Investors explore new innovative ways to position and differentiate the product on the market offering new value to both existing and new customer segments. In contrast to Red Ocean, this Blue Ocean strategy enables to extend or re-segment matured markets creating additional growth potential. - Emerging technology

Rapidly changing market trends and demands can diminish a product’s innovative features and value. To accelerate and sustain future long-term growth, investors need to be aware of what emerging technology can enhance a product's value, as well as what tech trends may threaten product growth and profitability. - Customer acquisition and retention potential

This area of evaluation looks at the future stream of customers who may switch to the product because of its mission, features, or innovation. It assesses how current customers are using the product, the level of their satisfaction with the existing product, and their "stickiness." It also looks at the percentage of customers—product ambassadors—ready to recommend the product to others. To accelerate and sustain future long-term growth, investors need to be aware of what emerging technology can enhance a product's value, as well as which tech trends threaten product growth and profitability. Statistics show that 90 percent of users tend to switch to a brand and stay loyal to it if the brand is socially responsible. Studies also show that up to 87 percent of consumers are ready to purchase if they like the company’s advocacy.

Now it’s time to have a better look at investment potential

After the product assessment through the views above, it’s time to look the at post-acquisition strategic roadmap, the product’s growth strategy, and the associated risks. Product due diligence cannot evaluate features in isolation.

It’s necessary to bind the data sets into coherently organized documented flows, diagrams, and charts. Finding strong dependencies and liaisons helps discover precise causes and reasons for possible product weaknesses or ways to improve a product’s strength to reveal realistic investment potential.

SoftServe’s approach to the Due Diligence process

Our experts evaluate a product through comprehensive business, customer, and technical assessment, allowing us to form a holistic view of its current performance and growth potential. We leverage market-proven methodologies such as lean product management, design thinking, and service design to perform this value-driven assessment. Here’s what it looks like.

Due diligence kick-off

The initiation stage aims to collect maximum information to reveal the investment context, investment scenarios, risks, and our client’s expectations from the investment plan. SoftServe’s approach to conducting due diligence lies in a clear understanding of all external and internal factors influencing product potential, along with the likelihood that the product will achieve its investment goals after an acquisition.

A personal approach focused on effective communication

Managing expectations is a prerogative to ensure that both sides are on the same page and share formalized opinions about the investment. SoftServe takes responsibility for facilitating communication with our client in the most efficient manner to help meet the investment goal. With professional tools, our experts will recommend future-in-mind decisions and present detailed data-driven judgment to help you invest confidently.

The team composition

Due diligence is conducted by principal and senior product strategists, product designers and software architects with vast domain experience. Throughout the product due diligence process, we guide all involved stakeholders with market and competitor analysis, in-depth customer interviews (active, inactive, and potential), code reviews, facilitated product strategy and road mapping sessions, growth-enabling features such as discovery through rapid prototyping, and user testing.

Deliverables

Deliverables of this process include a detailed report with recommendations, predicted risks, and key findings of conducting analysis for which versatile methods are used. A potential investor receives an in-depth report on the target company and the market and factors affecting the target’s ability to reach its forecast results. The informative report enables a prospective buyer to make a well-founded decision by revealing all potential risks associated with the target business.

The value you get with SoftServe

Product due diligence is a crucial stage in your investment journey. It requires holistic organization, coordination, and careful analysis. Collecting sensitive documents, performing market and customer research, working with various parties, and analyzing the received information—these activities are all essential to a successful deal.

At SoftServe, we help our clients reveal potential risks and suggest an optimal strategic roadmap to enable future product growth to increase investment success. Our approach to product due diligence is tailored to individual investment contexts and requirements.

Since 1993, we have designed and built digital products from idea to launch for leading ISVs and global enterprises. Our dedicated product management, design, and advanced technology centers of excellence have accumulated substantial practical experience and market-proven best practices. We use what we’ve learned to deliver high-value consulting services for our clients.

Let’s talk about how we can help you evaluate the investment potential of your high-tech target. We’ll cross-check your investment objectives with data-driven information to help you reach a business-driven decision.