Real-World Capabilities of Quantum Computing: A Showcase in Finance

Quantum computing holds vast potential, providing a unique opportunity to lead in innovation and gain a competitive edge. With governments and businesses investing in quantum technologies a record sum of over $35.5 billion worldwide, it looks like early adopters stand to reap the rewards, while those who delay risk falling behind.

Yet because of its early stage of development, there is a degree of hype and uncertainty surrounding quantum computing applications. Businesses grapple with identifying the specific use cases and precise problem domains where quantum computing offers advantages.

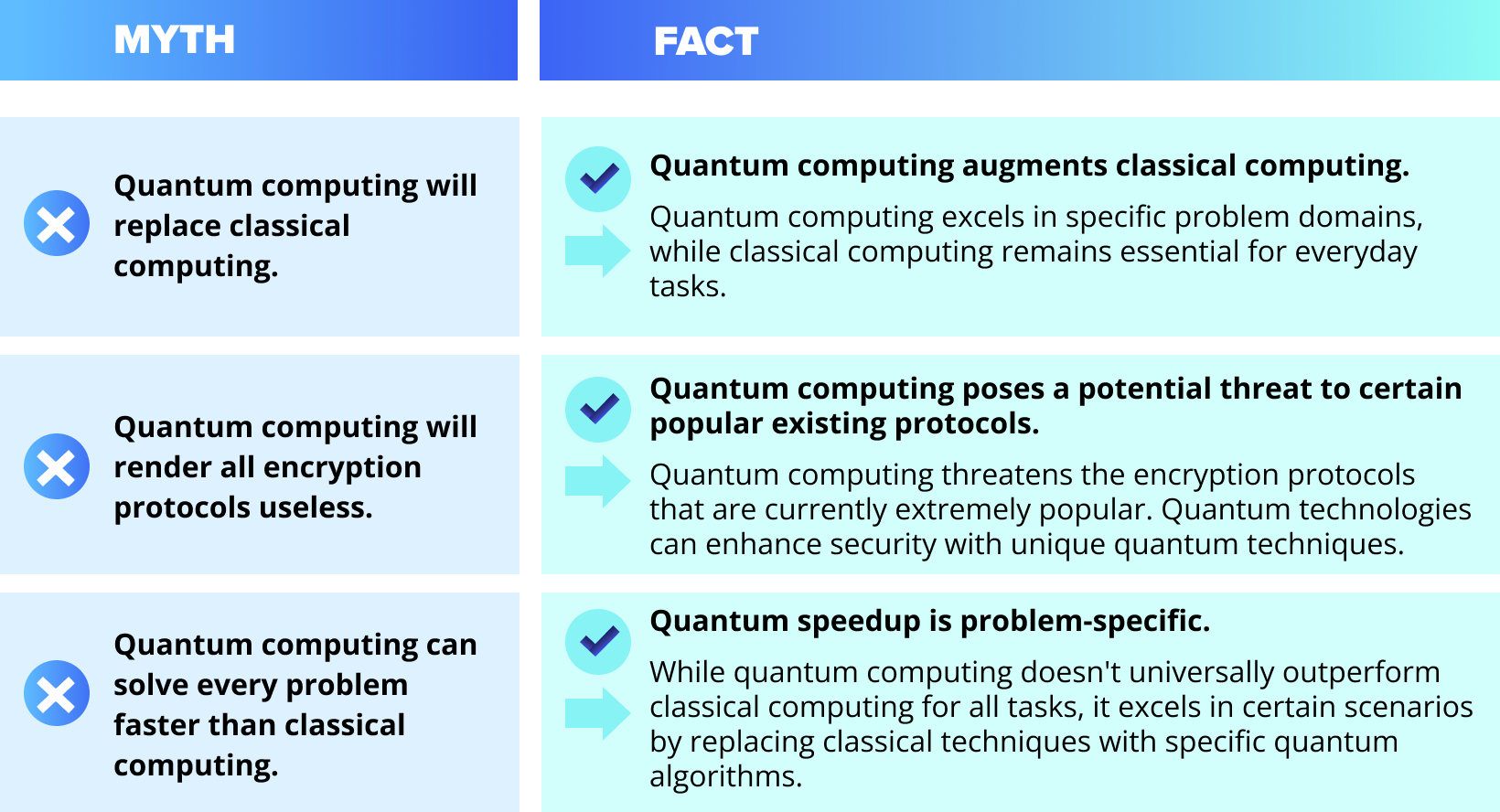

Misconceptions about this technology contribute to the overall confusion. Here are some prevalent myths in today’s business world.

Debunking Quantum Computing Myths

Harnessing Quantum Power: Immediate Business Opportunities

Another undeniable fact about quantum computing is that it offers immediate opportunities for businesses to harness. Here are a few of them.

1. Improve security protocols

In the age of quantum threats, quantum cryptography provides secure communication methods.

Let’s say your business is grappling with the challenge of securing sensitive customer data and proprietary information. Traditional encryption methods that use the RSA encryption protocol or similar are vulnerable to potential quantum attacks, creating a significant security risk.

To address this challenge, consider adopting quantum key distribution, a quantum encryption protocol, or classical quantum-resistant algorithms that ensure long-term data and communications security.

2. Perform complex simulations and modeling that classical computing cannot achieve

Quantum computing has far-reaching implications for advancing scientific research and technological breakthroughs.

Imagine your business is faced with the challenge of designing and manufacturing novel advanced materials with tailored properties for your products.

In this case, quantum computers can potentially perform precise modeling of quantum interactions and material properties. You’ll gain valuable insights, accelerate materials discovery, and improve product efficiency and performance.

3. Optimize processes for performance benefits

Quantum algorithms find efficient solutions faster than classical computers for solving complex optimization problems. This has broad applications in business, including supply chain management, logistics, financial portfolio optimization, and resource allocation.

For example, if your business is facing the challenge of optimizing its supply chain logistics, utilizing quantum computing can help you solve complex optimization problems more quickly and efficiently than classical computers.

SoftServe’s Workflow for Quantum Computing Solutions

Capitalizing on quantum computing opportunities requires a deliberate approach. The optimal strategy involves partnering with a service provider that offers end-to-end solutions, from use-case ideation to system integration, and possesses expertise across various industries.

At SoftServe, we engage in systematic collaboration and exploration to fully reap the benefits of quantum computing.

Discover the perfect starting point for your quantum computing journey. Engage in a workshop with SoftServe's R&D team, where you'll unearth the most valuable and impactful challenges specific to your business, ripe for effective solutions through the potential of quantum computing.

Identify Leading-Edge Solutions

Gain insights into potential solutions for your challenges from both classical and quantum perspectives. This will provide a benchmark for evaluating quantum solutions and alternatives as you embark on your quantum computing journey.

Assessing Implementation Feasibility

Get an understanding of resource estimation and timelines. We’ll provide research data that offers a comprehensive assessment of risks and benefits, covering technical, financial, and operational aspects. Explore the actual ROI you can achieve and make sure the potential benefits justify the investment.

Adoption and Integration

Obtain a comprehensive development roadmap designed to enhance your classical algorithms. Our team will strategically implement these changes, ensuring the seamless integration of quantum computing into your system in the future.

Financial Insights: Quantum Computing and Derivative Pricing

Let's see quantum computing in action. Our team recently responded to a request to investigate quantum computing for derivatives pricing. Recognizing the hype surrounding this concept, we immersed ourselves in exploration to uncover tangible benefits for our client.

IDENTIFYING THE USE CASE

The main goal of our client, a financial institution, was to improve their portfolio management decision-making processes. During the workshop, we uncovered two potential avenues to achieve this goal:

- Improving the portfolio optimization tools

- Creating additional models to streamline the process

We subsequently identified four distinct tracks for advancing this financial project, each progressing along its own path.

1.Reducing Costs with QAE Enhancement

The current solution used by the client employs Monte Carlo processes. Quantum computing offers a quadratic speedup through Quantum Monte Carlo, utilizing quantum amplitude estimation (QAE). However, QAE is notorious for being expensive in terms of gate costs. SoftServe started a track to improve the QAE scheme and created a new scheme that reduces the required number of CNOT gates by the number of qubits used, which paved the way for faster and more cost-effective quantum simulations.

2.Quantum Machine Learning for Option Pricing

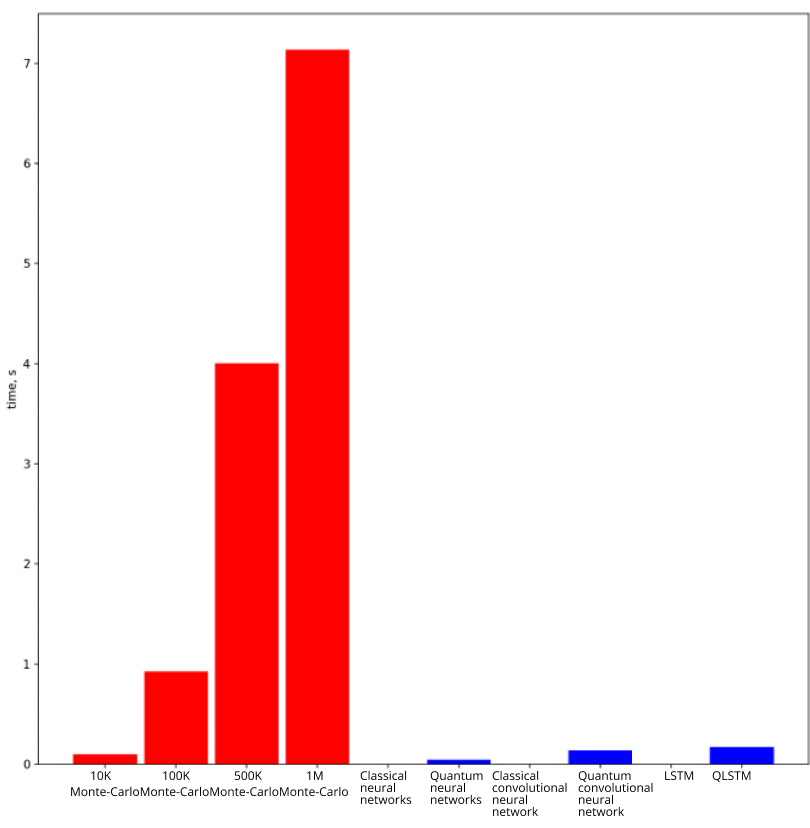

To overcome Monte Carlo limitations, we employed machine learning (ML) to create models with various option price parameters such as asset price, volatility, and strike price. We adapted validated classical ML algorithms to quantum machine learning (QML), achieving a significant 1000x speedup over traditional Monte Carlo methods while maintaining precision. This advances the prospects for QML.

Comparing runtime for Monte Carlo simulations (ranging from 10,000 to 1 million samples) to various classical and QML models. Significant time savings are evident with ML models.

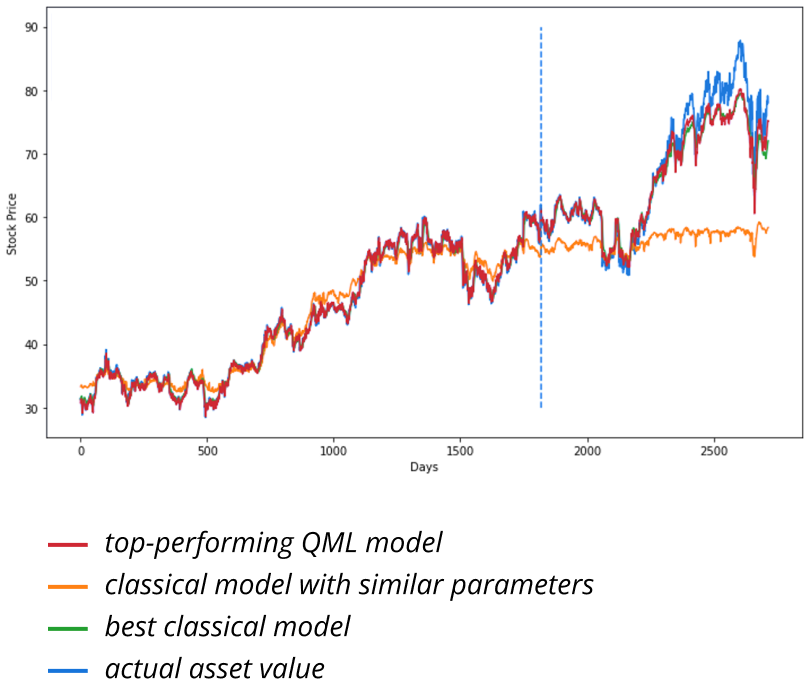

3.Asset Pricing Prediction

SoftServe designed a financial asset price forecasting modeling procedure using overnight market data through QML. We also created a statistical arbitrage strategy based on these models. The QML-based forecasts outperformed classical ML when using a similar number of parameters. Even with limited qubits, the best QML models showed comparable results to the best classical machine learning models.

Comparing quantum and classical models for asset price forecasting. Results show the QML and ML models perform similarly, but the classical model using fewer parameters underperforms.

4.Quantum-Aided Portfolio Optimization

Portfolio management poses a critical challenge for investment institutions and finding solutions can be computationally demanding.

In addressing this issue, we devised an algorithm that optimizes portfolios comprised of various assets, considering multiple parameters (such as Sharpe ratio and ESG score). This algorithm leverages a combination of factorization machines and quantum annealing, resulting in the generation of near-optimal portfolio candidates within a fixed timeframe.

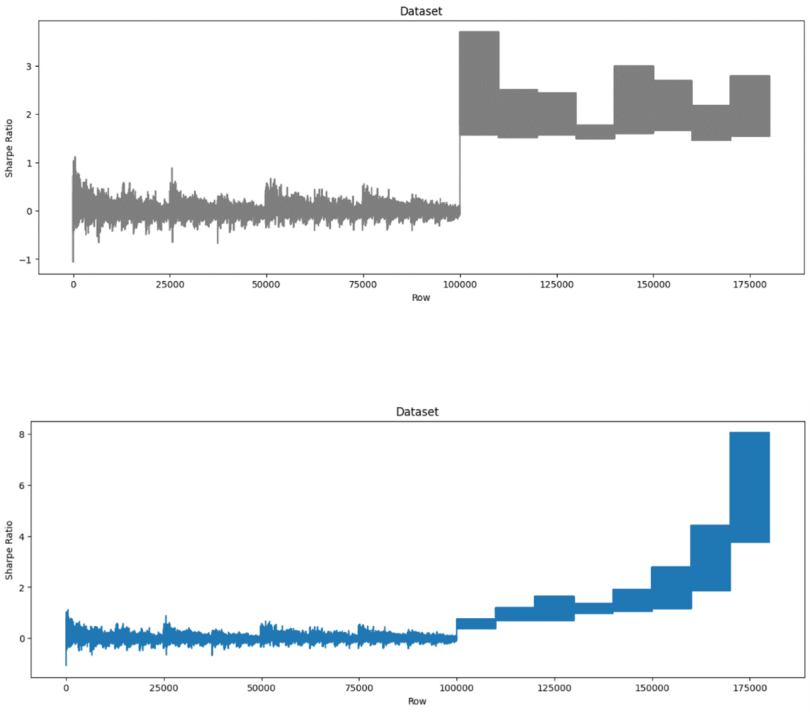

Comparison of a quantum algorithm (in blue) with traditional Monte Carlo simulations (in grey) on a 30-asset portfolio. The quantum algorithm exhibits an increase in Sharpe ratio as the dataset quality improves, a trend not observed in Monte Carlo simulations.

Conclusion

Early quantum computing adoption holds immense promise for industries dealing with complex simulations, extensive data processing, and optimization challenges.

Although quantum computing is still in its nascent stages, we're committed to making its practical applications, feasibility, and innovative solutions available for you.

Let's begin with a brief chat to understand your quantum journey and explore what quantum computing options fit your needs. Then, we can set up another session, whether it's a workshop to kickstart your quantum journey or a deep dive with our research engineers to evaluate your system.

Feel free to contact us to schedule a meeting.